Wouldn’t it be nice if there was an easy way to get a few extra dollars in your pocket each month to help with high gas prices for your car, truck or suv? Well if you haven’t yet gotten a Discover Card now is the time to do so.

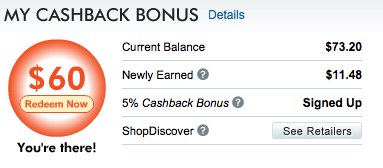

Just this month I have gotten over $60 cash back from just using it for our everyday family purchases (diapers and formula are expensive!)

Now the most important part when getting a cash back credit card is not to spend the cash back! They try and get you to purchase more things which means you spend more money instead of just getting the cash back. Now if those items you purchase are necessary items then by all means go for it, but most of the retailers that they list you could do without.

So if I can’t spend it what do I do with it? Redeem the cash back into your discover account and now you have those extra few dollars for those high gas prices!

You can also get a Discover card called the Open Road card that gives you more cash back for gas and auto purchases than the other Discover cards.

So if you spend money (and who doesn’t) or your a small business owner and want to get a few dollars back for doing what you would do anyway click on one of the links above to get your very own card today.